The Mortgage Stress Test Could Affect Your Dream Home

Thu, 16 Nov

We all dream about our perfect home, the one with open concept, bright and spacious rooms beautifully laid out with that living room set you saw at Restoration Hardware. You can almost hear the leaves sway gently as you step out the front door onto that beautiful tree-lined street in Ritchie. Then, you wake up, in front of some headline about Canada’s new mortgage “Stress Test”, and reality sets in.

Don’t Panic. It may not affect you and even if it does, you’re the resourceful type after all. You know how to stretch a budget and now you’re remembering that perfect living room set you saw at Structube. Everything is going to be okay.

Here’s What You Need to Know

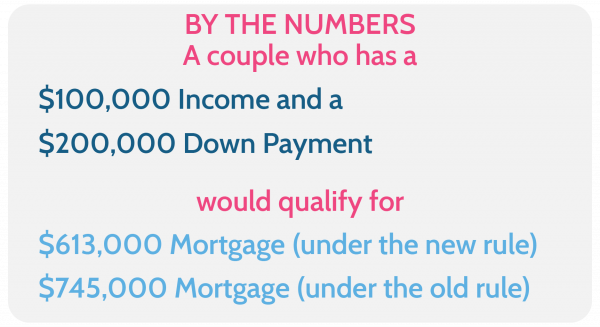

On January 1, 2018, all buyers that are ready to buy a home with a 20% down payment or greater, that are used to today’s way of qualifying for a mortgage, won’t be able to receive as many mortgage dollars as they thought they might be able to. This new “Stress Test” being implemented will reduce your borrowing power by 25%. It will also apply to refinancing a home and will reduce your refinancing ability by 25% compared to today. There’s still time to avoid these changes. If you’re considering buying in the near future, speak to someone today to see if this will affect you.

Mortgage qualifications are changing on January 1, 2018, and you can expect more adjustments to rates and qualifying factors coming soon.

A Bit of the WHY Behind These Changes

Over the last year, we have seen a few changes to the way mortgages work and people apply. The first Stress Test implemented in the summer of 2017 was done so to reduce the purchasing power of high ratio buyers (buyers with less than a 20% down payment). This was done to be sure buyers could easily afford and renew their mortgage in an economy where house prices may be high and rates are going up.

As of January 1st, 2018, the new Stress Test will apply to conventional financing, (buyers with a 20% down payment or more). This stress test will look a little different. For a buyer with 20% down, the Stress Test says that all lenders must qualify the borrower(s) at the Benchmark Rate. The Benchmark rate on the day of this writing is 4.99%

As mortgage Brokers, we have a formula that takes the interest rate into account along with your debt and your income and we produce a mortgage number that falls within an acceptable range of your borrowing opportunity. It is important to know that your contract rate is different than the Benchmark rate. That means the contract rate for your mortgage with good credit, a good job and an acceptable down payment and all things looking great would likely be between 2.99% to 3.09% for a five year fixed term. And this is the rate that your payment would be based on. ( so this is good) BUT…

As of January 1st 2018, buyers with a 20% down payment or more or that have equity in a home and are refinancing must qualify for a new mortgage or refinance at the greater of the Benchmark rate which at the time of this writing is at 4.99% or an interest rate 2% higher than the contract rate that your payment will be based on. This qualifying procedure will reduce your purchasing/refinancing ability by 25%.

Why did the rules change…well, the Federal Government is saying that rates are on the rise. They are also trying to control the overpriced housing market in the bigger cities like Vancouver and Toronto and we all have to follow suit.

The current stress test reduces a new buyer’s purchasing ability by 20% and the Stress test being implemented Jan 1st, 2018 reduces a conventional buyer’s purchasing ability by 25%. So, I can tell you that you could have had a bigger mortgage last summer but those days are changing.

Don’t Panic

Times have changed, but what has not is that owning a home is a fabulous asset in your financial portfolio, and often, an appreciating asset at that! Start shifting the rooms in your dream home and be prepared to get creative. Keep planning and dreaming about home ownership! Owning that home of your dreams is very, very possible. It just might take an extra step to get there.

At River City Financial we believe in financial education, we think that is where the power is. Yes you can still get a mortgage for your new home easily enough and yes you will still find stylish furniture that will fit into your new Edmonton house. Things are just a little tighter in the financing world today than yesterday, and your furniture will still look great in your new place!

Come chat with us at River City Financial and we will a have a full conversation and help you make the best decision for you. Anyone on my team at River City Financial will help you get ready for the next steps of home ownership and understand what you can afford.

Yvonne Wilchewski

River City Financial, Broker/Owner

CFF Bank Center, Owner

Yvonne Wilchewski is an accredited mortgage broker in Edmonton, Alberta. With over 20 years of experience in the Mortgage Industry, she offers mortgage ideas that will be profitable for you and your family. River City will strive to get you the best rates possible along with the best product for your specific mortgage needs.